Upcoming Courses

21 August 2024 [WEBINAR] Trusts in Personal and Corporate Insolvency: Establishing (and Dismantling) Trust Claims (2.5hrs)

Through this seminar, we will examine the concept of a trust in insolvency law, both from the creditor’s perspective (as a tool for enhanced recovery) and from the practitioner’s perspective (when faced with a claim that a trust exists). We will also review how various other common law jurisdictions have treated the interplay between equity and insolvency to give practical guidance to practitioners on what to expect, or prepare, to defend a trust claim.

Through this seminar, we will examine the concept of a trust in insolvency law, both from the creditor’s perspective (as a tool for enhanced recovery) and from the practitioner’s perspective (when faced with a claim that a trust exists). We will also review how various other common law jurisdictions have treated the interplay between equity and insolvency to give practical guidance to practitioners on what to expect, or prepare, to defend a trust claim.

Course Trainer

Jonathan Tang | Director | Prolegis LLC

Course Details

| Date | Time | Webinar | Public CPD Points | IPAS Member Price | Non-member Price | Registration and payment Deadline |

| 21 August 2024 | 2:00pm – 4:30pm | Trusts in Personal and Corporate Insolvency: Establishing (and Dismantling) Trust Claims | 2.5 | $250 | $300 | 19 August 2024 |

The course is SILE-accredited for 2.5 public CPD points, while accountants will be issued with a certificate of attendance (Category 4). Zoom access details will be included in the event confirmation email. Course handout (if any) will be emailed to participants on the day of the course.

Please contact us at courses@ipas.org.sg if you need further information.

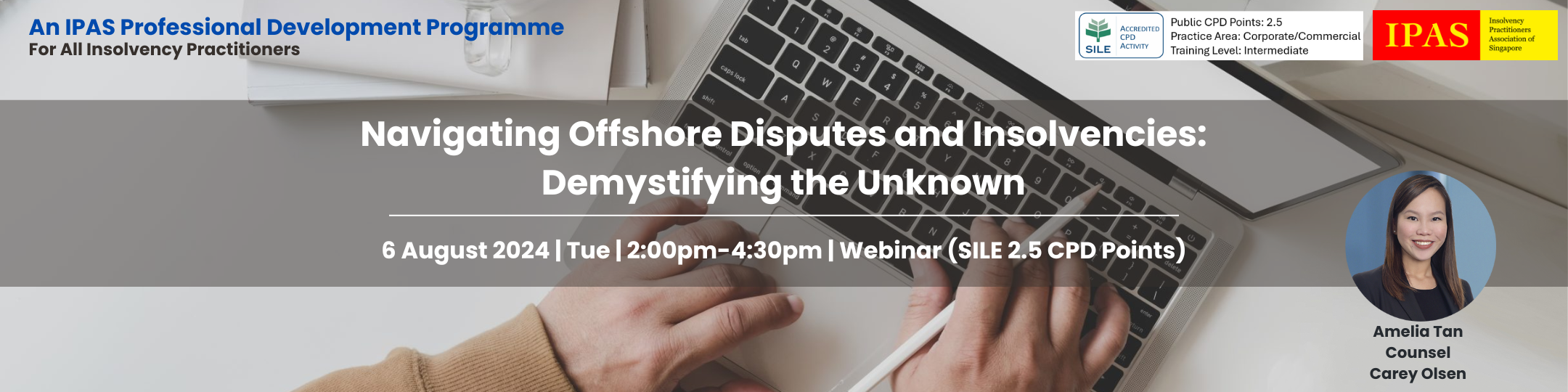

6 August 2024 [WEBINAR] Navigating Offshore Disputes and Insolvencies: Demystifying the Unknown (2.5hrs)

This webinar is designed for all, regardless of level of experience, who may deal with matters involving offshore entities, specifically in the British Virgin Islands (BVI) and the Cayman Islands. Legal practitioners, insolvency professionals, in-house counsel and bankers with an interest in this topic are encouraged to attend given the prevalent use offshore structures in cross-border deals.

This webinar is designed for all, regardless of level of experience, who may deal with matters involving offshore entities, specifically in the British Virgin Islands (BVI) and the Cayman Islands. Legal practitioners, insolvency professionals, in-house counsel and bankers with an interest in this topic are encouraged to attend given the prevalent use offshore structures in cross-border deals.

Course Trainer

Amelia Tan | Counsel | Carey Olsen

Course Details

| Date | Time | Webinar | Public CPD Points | IPAS Member Price | Non-member Price | Registration and payment Deadline |

| 6 August 2024 | 2:00pm – 4:30pm | Navigating Offshore Disputes and Insolvencies: Demystifying the Unknown | 2.5 | $250 | $300 | 4 August 2024 |

The course is SILE-accredited for 2.5 public CPD points, while accountants will be issued with a certificate of attendance (Category 4). Zoom access details will be included in the event confirmation email. Course handout (if any) will be emailed to participants on the day of the course.

Please contact us at courses@ipas.org.sg if you need further information.

Past Courses

10 July 2024 [WEBINAR] Going to Court: An Insolvency Practitioner’s Guide to Suing and Being Sued (3hrs)

Course Trainers Keith Tnee

About The Course Through this seminar, we hope to provide an understanding of (a) some of the typical applications that an insolvency practitioner may find himself bringing to Court, or defending in Court; and (b) what to expect when an insolvency practitioner decides to go to Court to bring a claim in the company’s name, or to defend a claim on behalf of the Company.

Intended for This Intermediate level course is intended for insolvency practitioners.

25 June 2024 [WEBINAR] House of Cards: Property Issues in Personal Bankruptcy (2.5hrs)

Course Trainers Tris Xavier

About The Course In Singapore, where real property constitutes a significant portion of individual wealth and often serves as their primary residence, personal bankruptcy results in such real property vesting in the Official Assignee or Private Trustee. Such vesting however is not without practical challenges when the property needs to be realised. Join us as we explore and discuss legal status of properties owned by bankrupts and practical solutions for managing them effectively.

Intended for This Intermediate level course is intended for insolvency practitioners.

20 Mar – 30 May 2024 [IN-PERSON] SMU-IPAS Graduate Certificate in Insolvency and Restructuring

The third intake of the SMU-IPAS Graduate Certificate in Insolvency and Restructuring programme was completed successfully on 30 May 2024. The programme has been developed to promote professional development training and technical competence of existing insolvency practitioners, and to provide the necessary education and training for newly qualified accountants, lawyers, and financial professionals who choose restructuring and insolvency as their specialisation. The course comprises of 11 modules covering the various core skills and knowledge of insolvency and restructuring. Participants who complete all the modules and pass the associated assessment for each module will receive the Graduate Certificate in Insolvency and Restructuring issued by the Singapore Management University. Each module may also be taken individually to fulfil continuing professional training requirements. This course is approved for SkillsFuture Singapore (SSG) funding, and eligible participants receive government subsidies of up to 90%. For more information on the programme or to be notified of the next intake, please visit https://academy.smu.edu.sg/courses/smu-ipas-graduate-certificate-insolvency-and-restructuring or contact courses@ipas.org.

15 May 2024 [WEBINAR] The Three-body Problem – the role of AI in the R&I practice (2.5hrs)

Course Trainers Adrian Chan, Chew Xiang, Sim Kwan Kiat

About The Course The webinar seeks to understand how AI may change the equilibrium between IPs and the legal advisors in the R&I practice, and delve deeper into some of the issues from the lens of Singapore’s insolvency practitioners and lawyers:

- Current and potential effects of AI on R&I practice such as how AI impacts data analysis and fraud detection;

- Potential benefits anticipated from AI integration;

- AI’s role in R&I court processes including dispute adjudication and mediation; and

- Legal concerns surrounding the use of AI such as confidentiality and data privacy.

Intended for This General level course is intended for insolvency practitioners.

19 March 2024 [WEBINAR] Common Forms of Set-off – Tips and Tricks Relating to the (somewhat) ‘Insolvency Proof’ Remedy (2.5hrs)

Course Trainer Alexander Lawrence Yeo

About The Course With new updates, this session will attempt to demystify the different and sometimes contradictory rules relating to the most common forms of set-off, and how and when it can be invoked to get relief from the consequences of counterparty insolvency.

- Webinar delves into set-off methods within bankruptcy proceedings, navigating complexities and prohibitions.

- Discusses prohibitions like moratoriums hindering standard remedies during bankruptcy.

- Focuses on contractual and equitable set-off, highlighting their differences and challenges.

- Equitable set-off requires tight links between claims, demonstrating historical evolution and diverse needs.

- Even without liquidated claims, equitable set-off is possible with a reasonable estimate.

- Contractual set-off allows parties to go beyond legal constraints, including contingent or future claims.

- Exact contractual language can eliminate mutuality requirements and the ability to set-off entirely.

- Emphasizes the importance of explicit and clear contractual agreements for reducing uncertainty and ensuring enforceability in the legal environment surrounding set-off.

Intended for This Intermediate level course is intended for insolvency practitioners.

7 December 2023 [WEBINAR] Cross-Border Recognition of Insolvency Proceedings between Singapore, Hong Kong, and Indonesia – Theory and Practice (2hrs)

Course Trainer Jonathan Tang, Alexander Aitken, Roni Marpaung, David Kim

About The Course This webinar discussion will explore how a Singapore scheme of arrangement or liquidation can be recognised and enforced in non-Model Law countries, and vice versa. Key topics will include the associated costs and benefits of commencing multiple proceedings in different jurisdictions, and what effect any extra-territorial moratorium granted by the Singapore courts under the IRDA has in preventing claims by foreign creditors even where the company has chosen to restructure in Singapore. In this webinar discussion, we will:

- Examine the key restructuring and insolvency processes and tools in Singapore, Hong Kong, and Indonesia;

- Examine the concept of COMI in Singapore and Hong Kong, with a comparison to the Cooperation Mechanism between the Hong Kong Court and the Mainland Court;

- Expand upon the present state of the law on cross-border recognition of insolvency proceedings by each of these jurisdictions, and how the respective courts are likely to treat attempts at recognising foreign insolvency processes;

- From an IP’s perspective, identify possible issues with recognition as foreign “officeholders” in each of these jurisdictions; and

- Consider how a group restructuring in Singapore concerning Hong Kong and Indonesian subsidiaries may play out in practice.

Intended For This Intermediate to Advanced level course is intended for insolvency practitioners.

9 November 2023 [WEBINAR] Strategic points in a contested scheme of arrangement (2hrs)

Course Trainer Sean Lee

About The Course In this course, we will review briefly the process of achieving a sanctioned scheme of arrangement, beginning with the preparation for the application for a moratorium under Section 64 of the Insolvency, Restructuring and Dissolution Act 2018, and ending with the application for the sanction of a scheme of arrangement under Section 210 of the Companies Act 1967. In the process, we will identify the key pressure points in a contested or potentially contested process, and the possible strategies at each of these key pressure points.

Intended For This Intermediate to Advanced level course is intended for insolvency practitioners.

25 October 2023 [WEBINAR] At the crossroads of arbitration and winding up: Latest developments and practical takeaways (2hrs)

Course Trainer Daniel Tan and Hoang Linh Trang

About The Course In this webinar we will:

- Explore the lower standard of review in disputed winding-up petitions and the abuse of process safeguard put in place by the Court of Appeal in AnAn Group (Singapore) Pte Ltd v VTB Bank (Public Joint Stock Company) [2020] SGCA 33

- Take stock of the latest developments from the English, Hong Kong and Singapore courts where the arbitration and winding up regimes clash. In particular, we will discuss and explore the recent Singapore Court of Appeal’s decision to overturn the High Court’s judgment in Founder Group (Hong Kong) Ltd (in liquidation) v Singapore JHC Co Pte Ltd [2023] SGHC 159

- Distil practical tips and best practices for practitioners when dealing with disputed winding up petitions and the underlying debt is subject to arbitration clauses.

Intended For This Intermediate to Advanced level course is intended for insolvency practitioners.

4 October 2023 [WEBINAR] Judicial Management for Sanctioned Entities (2hr 30mins)

Course Trainer Keith Han, Rabin Kok and Prakaash Silvam

About The Course The course will explore whether entities subject to asset-freezing and/or trade sanctions ought to consider placing themselves into judicial management in Singapore, and the benefits such a judicial management order can bring. We will discuss three recent English High Court judgments, in which the relevant sanctioned entities were placed into administration, and how this helped to alleviate and solve the commercial challenges faced by those entities. We will then go on to discuss how Singapore’s judicial management regime can be similarly used to address these issues. Participants will learn about the common legal and practical issues that Singapore and foreign sanctions pose for insolvency practitioners and their clients, and how these are typically dealt with. They will also gain a better understanding of the judicial management regime in Singapore and, drawing from the recent English cases on the UK administration regime, how the JM regime can be used to resolve / alleviate these issues.

Intended For This Intermediate to Advanced level course is intended for insolvency practitioners.

27 September 2023 [WEBINAR] The Ten Issues Every Insolvency Practitioner Knows (2hr 30mins)

Course Trainer Paul Seah and Keith Tnee

About The Course This course provides a framework of 10 issues that guide experienced insolvency practitioners case after case.

The 10 issues are framed following largely how the life cycle of restructuring and liquidation processes typically unfolds.

Part I: Companies in distress

- When is a company insolvent? Two tests.

- Pitfalls when a company is insolvent – insolvent trading, directors’ duties, preferential transactions.

Part II: Restructuring a distressed company

- Consensual restructuring vs formal restructuring

What kind of restructuring would be more appropriate

- The life cycle of a successful formal restructuring

Moratorium under section 64 of the IRDA – scheme of arrangement – exit and implementation of scheme / judicial management – exit Judicial management (or interim judicial management) – exit

- Creditors outreach – the importance of managing creditors and their expectations (especially in a restructuring context)

- Dealing with different stakeholders – shareholders, management, employees, banks, trade creditors, insurers, etc

- Ipso facto clauses – s 440 IRDA

Part III: End of a company’s life cycle

- Types of liquidation – Voluntary (by Creditors or Members) vs Court-ordered liquidation

- Third-party funding for dispute resolution proceedings

Professional Fees

- Securing professional adviser’s fees from a distressed company, taxation of professional fees in Court.

Intended For This Intermediate to Advanced level course is intended for insolvency practitioners.

23 August 2023 [WEBINAR] Navigating the maze: Unveiling Fraud and Investigations Insolvency (2hr 30mins)

Course Trainer Tan Siang Hwee

About The Course Participants will be provided with an insight into the types and motivations of fraud through understanding the importance of an investigation methodology and forensic means to uncovering valuable evidence. This module will further discuss the obligations of an insolvency practitioner when faced with circumstances involving fraud bearing in mind the end goal of maximising asset recovery.

Intended For This Intermediate to Advanced level course is intended for insolvency practitioners.

26 July 2023 [WEBINAR] The IRDA: After Three Years (2hr 30mins)

Course Trainers Mitchell Yeo and David Kim

About The Course In this session, we take stock of the developments in Singapore restructuring and insolvency law and practice since the time when the IRDA came into effect on 30 July 2020, fittingly just days before the third anniversary of its commencement. The review of key developments will include those occurring in statute, subsidiary legislation and cases. Topics discussed will span liquidation, personal bankruptcy, judicial management, schemes of arrangement, cross-border insolvency, the simplified insolvency programme, and selected practical points arising in restructuring and insolvency matters.

Intended For This Intermediate to Advanced level course is intended for insolvency practitioners.

13 July 2023 [IN-PERSON] IPAS’s Inaugural Masterclass Demystifying Schemes – More than Dotting i’s and Crossing t’s

Course Trainers Daniel Liu and Muhammed Ismail Noordin

About The Course Terms such as “cash sweep” and “waterfall” often arise in negotiations or discussions on restructurings. Exactly how these terms are put into effect is much less often discussed. IPAS’s first masterclass session seeks to bridge the commercial terms used in restructuring discussions and the language used in documentation to bring the commercial terms into effect. Participants can expect a walkthrough of the documentation involved in a scheme of arrangement, including the typical types of clauses that are included in the key documents in a scheme of arrangement. Restructuring professionals who have experience in negotiating commercial terms or are more attuned to the commercial or financial side of a restructuring will gain insights into document drafting during this session. Rather than leaving details that may potentially break a deal to the drafters, restructuring professionals who understand how agreements are put into writing can have an edge in live-drafting of documents which may need to be done in fast-paced restructurings. Participants with prior experience in schemes of arrangement are invited to share their experience with the group to assist in developing a deeper understanding of the documentation involved in implementing commercial agreements that are often discussed in restructurings. This masterclass will be facilitated by Daniel and Ismail of WongPartnership LLP.

Intended For

This Advanced level course is intended for:

- Insolvency practitioners/Financial Advisors

- Corporate Restructuring Professionals

- Financial Analysts

- Lenders/Borrowers

- In-house Legal Counsels

18 April to 6 July 2023 [IN-PERSON] SMU-IPAS Graduate Certificate in Insolvency and Restructuring 2023

Developed and taught by leading insolvency practitioners in collaboration with SMU Academy, the course is designed to provide participants with the fundamental/ foundational knowledge of insolvency and restructuring that is practical and relevant for recently qualified accountants, lawyers, and financial professionals who choose to specialise in insolvency and restructuring. This will also be an excellent opportunity for you to network with fellow R&I practitioners, and to learn from each other. The course comprises of eleven (11) modules covering the various core skills and knowledge of insolvency and restructuring. Participants who complete all eleven modules and pass the associated assessment for each module will receive the Graduate Certificate in Insolvency and Restructuring issued by the Singapore Management University. Each module may also be taken individually to fulfil continuing professional training requirements.

This course has been approved for SkillsFuture Singapore (SSG) funding, and eligible participants will receive government subsidies of up to 90%.

27 June 2023 [WEBINAR] Adjudication of Claims in Insolvency Administration (3hr 30mins)

Course Trainers Ivan Chong and Koh Junxiang

About The Course The course will cover the following aspects:

- Brief overview: Types of insolvency administration.

- Creditors’ rights, why and how to file a claim with insolvency practitioners.

- Adjudicating a filed claim – admission, additional information, rejection (and appeal).

- Statutory regime for distribution of assets and Dividend distribution(s).

- Pari-passu principle and its exceptions.

Intended For This Intermediate to Advanced level course is intended for insolvency practitioners.

19 May 2023 [WEBINAR] Tips and tricks in the restructuring and insolvency of crypto companies (2hrs)

Course Trainers Alexander Lawrence Yeo and Andrew Chan

About The Course

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

26 April 2023 [WEBINAR] Holistic turnaround via combined operational and financial restructuring (2.5hrs)

Course Trainers Matt Hinds, Lim Lian Hoon, and Michael Haftl

About The Course

- What does it look like – involves making material changes to the operations of the company, not just to its capital structure.

- Why do it – fixing the capital structure on its own is rarely enough, as the company has become distressed with its current operations.

- How to approach it building a plan

- “Find where it’s bleeding” quickly – typically by region, product line or business unit.

- “Stem the bleeding” within a timescale that makes sense – what levers to consider and why.

- Model the options and choose the preferred plan based on iterations with items 4 and 5.

- Minimise cash bleed in the current situation

- Figure out how big the “cash hole” is – how much new money is needed, and a timeline and process for

- New money to enter

- Operational changes to be implemented

- Consensual or court process to take effect

- Cases from a few different industries will be used (with sanitised data) to illustrate the above approaches.

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

16 February 2023 [WEBINAR] Cryptoassets, a primer on insolvency and asset recovery (2hrs)

Course Trainers Ivan Chong, Jansen Chow, and Stanley Tan

About The Course

The past year has been a watershed year for the cryptocurrency space, where numerous cryptocurrency-related entities have sought insolvency protection and freezing injunctions in Singapore and other jurisdictions as they scramble to fend off mass withdrawals and recover lost assets. In fact, since issuing its first freezing injunction of cryptoassets against persons unknown in 2021, the Singapore Court has adjudicated on multiple insolvency-related applications by cryptocurrency entities in the likes of Torque, Vauld, Zipmex, 3 Arrows Capital and Hodlnaut. In this course, Ivan Chong of Kroll, Jansen Chow and Stanley Tan of Rajah & Tann Singapore LLP will consider some of the common legal and practical challenges relating to insolvency and asset recovery in the cryptocurrency space, before proffering possible solutions to overcoming them.

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

6 December 2022 [WEBINAR] A clash of regimes: Navigating the intersection between insolvency and arbitration (2hrs)

About The Course

This webinar will explore:

- The differing approaches that the English, Hong Kong and Singapore Courts have taken in winding-up petitions where the debt is disputed and subject to arbitration;

- The lower standard of review in disputed winding-up petitions and the abuse of process safeguard put in place by the Court of Appeal in AnAn Group (Singapore) Pte Ltd v VTB Bank (Public Joint Stock Company) [2020] SGCA 33

- The practical difficulties faced by the petitioning creditor where the debt is disputed and subject to arbitration;

- A recent case study which engages the issues above.

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

30 November 2022 [WEBINAR] Contemporary Issues in Judicial Management (2hrs)

About The Course

First introduced in 1987, the regime of judicial management has undergone recent facelifts in the new Insolvency, Restructuring and Dissolution Act (“IRDA”). As the framework now settles into its respectable middle age, some critical reflection may be due. How has judicial management fared as a rehabilitative regime, alongside more modern innovations? Are the recent updates sufficient to address some longstanding issues with judicial management, and if not, what more can be done? This seminar will critically assess the modern constraints and opportunities facing judicial managers, in both law and practice. Can judicial management be deployed as a distributive regime, with dividends to creditors prior to liquidation or a scheme? Has there been a shift in the test for appointing judicial managers, and how far can the public interest exception be relied on? How should judicial managers respond to challenges against their decisions? What are the subtle changes brought about by IRDA and its subsidiary legislation, which may require judicial managers to rethink practical issues such as priorities, fees and funding? This seminar is aimed at practitioners and students keen on a deeper dive into the judicial management regime.

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

16 November 2022 [WEBINAR] Principles of Financial Restructuring (3hrs)

About The Course In this course targeted at beginner to intermediate practitioners, participants will learn about components of a financial restructuring, approaches taken in debt and equity restructurings and see how these have been applied in real-life case studies.

Intended For

This Beginner to Intermediate level course is intended for insolvency practitioners.

20 September 2022 [WEBINAR] Common forms of set-off – Tips and tricks relating to the (somewhat) ‘insolvency proof’ remedy (2hrs)

About The Course This session will attempt to demystify the different and sometimes contradictory rules relating to the most common forms of set-off, and how and when it can be invoked to get relief from the consequences of counterparty insolvency.

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

18 July 2022 [WEBINAR] Going to Court: An Insolvency Practitioner’s Guide to Suing and Being Sued (3hrs)

About The Course Through this seminar, we hope to provide an understanding of (a) some of the typical applications that an insolvency practitioner may find himself bringing to Court, or defending in Court; and (b) what to expect when an insolvency practitioner decides to go to Court to bring a claim in the company’s name, or to defend a claim on behalf of the Company.

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

15 July 2022 [WEBINAR] Rescue Financing (2hrs)

About The Course The course will cover: • Introduction to the rescue financing regime under sections 64 and 101 of the Insolvency, Restructuring and Dissolution Act 2018 (“Insolvency Act”). • Who can apply for rescue financing. • Definition of rescue financing under the Insolvency Act. • Different levels of super-priority that may be afforded under the rescue financing regime. • Requirements for obtaining rescue financing order. • Key considerations for rescue lenders. • Strategies for rescue lenders. • Process for implementing a rescue financing deal. • Case study of the rescue financing deal in the restructuring of the Design Studio Group

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

14 July 2022 [WEBINAR] Cross-Border Insolvency: Selected Issues and Practical Tips (3hrs)

About The Course In this session, we will explore how the Model Law has been specifically drafted and developed in Singapore, as well as current issues that have arisen in the practice of cross-border insolvency in Singapore. In doing so, we will examine the issues and solutions that have arisen in recent high-profile cross-border restructurings involving teams in Singapore. From there, we distill practical tips and best practices for your consideration in future matters.

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

13 July 2022 [WEBINAR] Strategic points in a contested scheme of arrangement (2hrs)

About The Course The course will cover the following aspects:

- Brief overview of the process of a scheme of arrangement.

- Identification of the key pressure points in a contested or potentially contested scheme of arrangement.

- Possible strategies at each of these key pressure points.

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

8 July 2022 [WEBINAR] Adjudication of Claims in Insolvency Administration (3hr 30mins)

About The Course The course will cover the following aspects:

- Brief overview: Types of insolvency administration.

- Creditors’ rights, why and how to file a claim with insolvency practitioners.

- Adjudicating a filed claim – admission, additional information, rejection (and appeal).

- Statutory regime for distribution of assets and Dividend distribution(s).

- Pari-passu principle and its exceptions.

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

7 July 2022 [WEBINAR] Rules of Court 2021: Navigating the new civil procedure rules (2hrs)

About The Course This seminar will provide practitioners with an introduction to the newly enacted Rules of Court 2021, which came into force on 1 April 2022. We will explore the major structural changes which have been introduced, including the “Single Application Pending Trial” and the power of the Court to order Affidavits of Evidence-in-Chief to be filed before discovery. The seminar also aims to look into some of the innovations which have been introduced, and with reference to the practice in other jurisdictions, explore how these innovations will likely be implemented in Singapore. In order to benefit insolvency practitioners in particular, we will explore how these new Rules of Court will impact particular applications which are made in the insolvency context, for instance an application for clawback where there is unfair preference or undervalue transactions.

The main topics to be covered are:

- Introduction to the Rules of Court 2021

- Ideals of the Rules of Court 2021 and New Terminology

- Pre-action Protocol – Duty to Consider Amicable Resolution

- Originating Claims

- Originating Applications

- Case Conferences and Interlocutory Matters

- Disclosure and Production of Documents

- Expert Evidence

- Trial and Appeals

- Application of Rules of Court 2021 to Insolvency & Restructuring Practice

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

26 March 2022 to 4 June 2022 SMU-IPAS Graduate Certificate in Insolvency and Restructuring About The Course The SMU-IPAS Graduate Certificate in Insolvency and Restructuring, developed in collaboration with the SMU Academy, is a post-graduate course developed and taught by leading insolvency practitioners. The course provides participants with the fundamental/ foundational knowledge of insolvency and restructuring that is practical and relevant for recently qualified accountants, lawyers and financial professionals who choose to specialise in insolvency and restructuring. The course comprises of eleven (11) modules covering the various core skills and knowledge of insolvency and restructuring. Participants who complete all eleven modules and pass the associated assessment for each module will receive the Graduate Certificate in Insolvency and Restructuring issued by the Singapore Management University. Each module may also be taken individually to fulfil continuing professional training requirements. The inaugural course will take place from 26 March to 4 June.

8 December 2021 [WEBINAR] Overview of Insolvency, Restructuring and Dissolution Act (3hr 30mins)

About The Course

This course provides an overview of the new Insolvency, Restructuring and Dissolution Act 2018 and the implications of the changes to various stakeholders.

Intended For

This Beginners to Intermediate level course is intended for all who need to reference the Insolvency, Restructuring and Dissolution Act 2018 in the course of their debt restructuring and insolvency work in Singapore and CFOs.

7 December 2021 [WEBINAR] Unravelling Fraud in Insolvency (1hr 15mins)

About The Course

What should and can an Insolvency Officeholder do when presented with suspicions of fraud? In this session, the discussions will cover: • the role and responsibilities of the judicial manager or liquidator when presented with suspicions of fraud; • the practical and legal considerations before deciding to commence investigations; • practical tips and considerations when conducting an investigation; and • the legal tools available to the judicial manager or liquidator to aid the investigations

Intended For

This course is intended for insolvency practitioners.

30 November 2021 [WEBINAR] Adjudication of claims in insolvency administration (3hr 30mins)

About The Course The course will cover the following aspects:

- Brief overview: Types of insolvency administration.

- Creditors’ rights, why and how to file a claim with insolvency practitioners.

- Adjudicating a filed claim – admission, additional information, rejection (and appeal).

- Statutory regime for distribution of assets and Dividend distribution(s).

- Pari-passu principle and its exceptions.

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

29 November 2021 [WEBINAR] The Critical First 100 Days of Debt Restructuring (1hr 15mins)

About The Course

The first 100 days of a debt restructuring exercise for a distressed company is always closely scrutinised as it sets out the priorities to be dealt with. In the context of a restructuring mandate, what is the insolvency practitioner expected to accomplish in the first 100 days? What pressing legal, financial and operational issues should be dealt with, and how should these be prioritised? Join us in examining how the first 100 days of a restructuring will (or should) unfold.

Intended For

This foundation level course is intended for litigators and those starting out in restructuring and insolvency practice.

22 November 2021 [WEBINAR] The Ten Issues Every Insolvency Practitioner Knows (2hr 30mins)

About The Course

This course provides a framework of 10 issues that guide experienced insolvency practitioners case after case. The 10 issues are framed following largely how the life cycle of restructuring and liquidation processes typically unfolds. Part I: Companies in distress

- When is a company insolvent? Two tests.

- Pitfalls when a company is insolvent – insolvent trading, directors’ duties, preferential transactions.

Part II: Restructuring a distressed company

- Consensual restructuring vs formal restructuring

What kind of restructuring would be more appropriate

- The life cycle of a successful formal restructuring

Moratorium under s 211B – scheme of arrangement – exit and implementation of scheme / judicial management – exit Judicial management (or interim judicial management) – exit

- Creditors outreach – the importance of managing creditors and their expectations (especially in a restructuring context)

- Dealing with different stakeholders – shareholders, management, employees, banks, trade creditors, insurers, etc

- Ipso facto clauses – s 440 IRDA

Part III: End of a company’s life cycle

- Types of liquidation – Voluntary (by Creditors or Members) vs Court-ordered liquidation

- Third-party funding for dispute resolution proceedings

Professional Fees

- Securing professional adviser’s fees from a distressed company, taxation of professional fees in Court.

Intended For

This foundation level course is intended for litigators and those starting out in restructuring and insolvency practice.

9 June 2021 [WEBINAR] Unravelling Fraud in Insolvency (1hr 15mins)

About The Course

What should and can an Insolvency Officeholder do when presented with suspicions of fraud? In this session, the discussions will cover: • the role and responsibilities of the judicial manager or liquidator when presented with suspicions of fraud; • the practical and legal considerations before deciding to commence investigations; • practical tips and considerations when conducting an investigation; and • the legal tools available to the judicial manager or liquidator to aid the investigations

Intended For

This course is intended for insolvency practitioners.

3 June 2021 [WEBINAR] The Ten Issues Every Insolvency Practitioner Knows (2hr 30mins)

About The Course

This course provides a framework of 10 issues that guide experienced insolvency practitioners case after case. The 10 issues are framed following largely how the life cycle of restructuring and liquidation processes typically unfolds. Part I: Companies in distress

- When is a company insolvent? Two tests.

- Pitfalls when a company is insolvent – insolvent trading, directors’ duties, preferential transactions.

Part II: Restructuring a distressed company

- Consensual restructuring vs formal restructuring

What kind of restructuring would be more appropriate

- The life cycle of a successful formal restructuring

Moratorium under s 211B – scheme of arrangement – exit and implementation of scheme / judicial management – exit Judicial management (or interim judicial management) – exit

- Creditors outreach – the importance of managing creditors and their expectations (especially in a restructuring context)

- Dealing with different stakeholders – shareholders, management, employees, banks, trade creditors, insurers, etc

- Ipso facto clauses – s 440 IRDA

Part III: End of a company’s life cycle

- Types of liquidation – Voluntary (by Creditors or Members) vs Court-ordered liquidation

- Third-party funding for dispute resolution proceedings

Professional Fees

- Securing professional adviser’s fees from a distressed company, taxation of professional fees in Court.

Intended For

This foundation level course is intended for litigators and those starting out in restructuring and insolvency practice.

1 June 2021 [WEBINAR] Rescue Financing (2hrs) About The Course This course introduces the rescue financing regime under the Insolvency, Restructuring and Dissolution Act 2018 (“Insolvency Act”). The course will cover:

- Introduction to the rescue financing regime under sections 64 and 101 of the Insolvency Act.

- Who can apply for rescue financing.

- Definition of rescue financing under the Insolvency Act.

- Different levels of super-priority that may be afforded under the rescue financing regime.

- Requirements for obtaining rescue financing order.

- Key considerations for rescue lenders.

- Strategies for rescue lenders.

- Process for implementing a rescue financing deal.

- Case study of the rescue financing deal in the restructuring of the Design Studio Group

Intended For This Intermediate to Advanced level course is intended for insolvency practitioners.

24 May 2021 [WEBINAR] Overview of Insolvency, Restructuring and Dissolution Act (3hr 30mins)

About The Course

This course provides an overview of the new Insolvency, Restructuring and Dissolution Act 2018 and the implications of the changes to various stakeholders.

Intended For

This Beginners to Intermediate level course is intended for all who need to reference the Insolvency, Restructuring and Dissolution Act 2018 in the course of their debt restructuring and insolvency work in Singapore and CFOs.

11 May 2021 [WEBINAR] The Critical First 100 Days of Debt Restructuring (1hr 15mins)

About The Course

The first 100 days of a debt restructuring exercise for a distressed company is always closely scrutinised as it sets out the priorities to be dealt with. In the context of a restructuring mandate, what is the insolvency practitioner expected to accomplish in the first 100 days? What pressing legal, financial and operational issues should be dealt with, and how should these be prioritised? Join us in examining how the first 100 days of a restructuring will (or should) unfold.

Intended For

This foundation level course is intended for litigators and those starting out in restructuring and insolvency practice.

8 December 2020 [Webinar] Adjudication of claims in insolvency administration

About The Course The course will cover the following aspects:

- The creditors and their rights in the context of a company in liquidation.

- The statutory regime for distribution of assets of a company in liquidation.

- The pari passu principle and its exceptions.

- The process of filing a claim.

- The process of dealing with a filed claim – admission, rejection and the appeal

- The dividend – what is it in essence

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

1 December 2020 [Webinar] Investigations in insolvency assignments

About The Course This course focuses on the need for, and aspects of conducting investigations in liquidation assignments and areas to look out for by a liquidator.

Intended For This Intermediate to Advanced level course is intended for insolvency practitioners.

26 November 2020

An Introduction to Judicial Management The first half of 2020 has seen a spate of judicial management applications by bank creditors, financial institutions as well as by borrowers themselves. Why judicial management and what advantages does judicial management have over other corporate rescue regimes, and is judicial management suitable in all cases? This course will introduce you to the legal framework and key principles behind judicial management, and will include a discussion on:

- The aims and purposes of judicial management,

- Key differences between judicial management, liquidation and schemes of arrangement,

- How creditors can place a company into judicial management,

- The substantive effects of a judicial management order,

- Latest updates to the judicial management framework under the Insolvency, Restructuring and Dissolution Act, which came into force on 30 July 2020,

- Practical insights from a practitioners’ viewpoint, and

- Selected highlights from recent judicial management cases.

Intended For This Foundation level course is intended for insolvency practitioners.

19 November 2020 Overview of Insolvency, Restructuring and Dissolution Act

About The Course

This course provides an overview of the new Insolvency, Restructuring and Dissolution Act 2018 and the implications of the changes to various stakeholders.

Intended For

This Beginners to Intermediate level course is intended for all who need to reference the Insolvency, Restructuring and Dissolution Act 2018 in the course of their debt restructuring and insolvency work in Singapore and CFOs.

6 November 2020 Rescue Financing About The Course This course introduces the rescue financing regime under the Insolvency, Restructuring and Dissolution Act 2018 (“Insolvency Act”). The course will cover:

- Introduction to the rescue financing regime under sections 64 and 101 of the Insolvency Act.

- Who can apply for rescue financing.

- Definition of rescue financing under the Insolvency Act.

- Different levels of super-priority that may be afforded under the rescue financing regime.

- Requirements for obtaining rescue financing order.

- Key considerations for rescue lenders.

- Strategies for rescue lenders.

- Process for implementing a rescue financing deal.

- Case study of the rescue financing deal in the restructuring of the Design Studio Group

Intended For This Intermediate to Advanced level course is intended for insolvency practitioners.

4 September 2020 [WEBINAR] Unravelling Fraud in Insolvency

About The Course

What should and can an Insolvency Officeholder do when presented with suspicions of fraud? In this session, the discussions will cover: • the role and responsibilities of the judicial manager or liquidator when presented with suspicions of fraud; • the practical and legal considerations before deciding to commence investigations; • practical tips and considerations when conducting an investigation; and • the legal tools available to the judicial manager or liquidator to aid the investigations

Intended For

This course is intended for insolvency practitioners.

31 August 2020 [WEBINAR] The Ten Issues Every Insolvency Practitioner Knows

About The Course

This course provides a framework of 10 issues that guide experienced insolvency practitioners case after case. The 10 issues are framed following largely how the life cycle of restructuring and liquidation processes typically unfolds. Part I: Companies in distress

- When is a company insolvent? Two tests.

- Pitfalls when a company is insolvent – insolvent trading, directors’ duties, preferential transactions.

Part II: Restructuring a distressed company

- Consensual restructuring vs formal restructuring

What kind of restructuring would be more appropriate

- The life cycle of a successful formal restructuring

Moratorium under s 211B – scheme of arrangement – exit and implementation of scheme / judicial management – exit Judicial management (or interim judicial management) – exit

- Creditors outreach – the importance of managing creditors and their expectations (especially in a restructuring context)

- Dealing with different stakeholders – shareholders, management, employees, banks, trade creditors, insurers, etc

- Ipso facto clauses – s 440 IRDA

Part III: End of a company’s life cycle

- Types of liquidation – Voluntary (by Creditors or Members) vs Court-ordered liquidation

- Third-party funding for dispute resolution proceedings

Professional Fees

- Securing professional adviser’s fees from a distressed company, taxation of professional fees in Court.

Intended For

This foundation level course is intended for litigators and those starting out in restructuring and insolvency practice.

21 August 2020 [WEBINAR] The Critical First 100 Days of Debt Restructuring

About The Course

The first 100 days of a debt restructuring exercise for a distressed company is always closely scrutinised as it sets out the priorities to be dealt with. In the context of a restructuring mandate, what is the insolvency practitioner expected to accomplish in the first 100 days? What pressing legal, financial and operational issues should be dealt with, and how should these be prioritised? Join us in examining how the first 100 days of a restructuring will (or should) unfold.

Intended For

This foundation level course is intended for litigators and those starting out in restructuring and insolvency practice.

13 December 2019 Business Valuation in Distressed Environments

About The Course

This customised seminar course links the theory and practical aspects of business valuation and will provide participants with first-hand knowledge of how valuation is to be carried out in a distressed environment. The seminar will provide an insight into the valuation context and cover areas pertaining to corporate valuation incorporating the fundamental concepts and principles of valuation. It will then include in depth discussions on the valuation process to be adopted, the standard and premise of value as well as the various valuation approaches/methodologies commonly applied. In particular, issues relating to distressed valuation will be discussed and the seminar will be conducted via an interactive manner utilising appropriate case studies.

Intended For

This Intermediate to Advanced Level course is intended for insolvency practitioners and financial analysts.

10 December 2019 Overview of Insolvency, Restructuring and Dissolution Act

About The Course

This course provides an overview of the new Insolvency, Restructuring and Dissolution Act 2018 and the implications of the changes to various stakeholders.

Intended For

This Beginners to Intermediate level course is intended for all who need to reference the Insolvency, Restructuring and Dissolution Act 2018 in the course of their debt restructuring and insolvency work in Singapore and CFOs.

5 December 2019 Schemes of Arrangement

About The Course

This course provides a focused study of Schemes of Arrangement, eligibility considerations, governing laws, Court procedures, pros and cons, impact on various stakeholders.

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

3 December 2019 Adjudication of Claims in Insolvency Administration

About The Course The course will cover the following aspects:

- The creditors and their rights in the context of a company in liquidation.

- The statutory regime for distribution of assets of a company in liquidation.

- The pari passu principle and its exceptions.

- The process of filing a claim.

- The process of dealing with a filed claim – admission, rejection and the appeal

- The dividend – what is it in essence

Intended For

This Intermediate to Advanced level course is intended for insolvency practitioners.

12 November 2019 Investigations in Insolvency Assignments

About The Course This course focuses on the need for, and aspects of conducting investigations in liquidation assignments and areas to look out for by a liquidator.

Intended For This Intermediate to Advanced level course is intended for insolvency practitioners.